AMMAN — Jordan

relies on foreign assistance to finance capital projects, as the country’s

domestic revenues are insufficient to fund new projects due to limited

available fiscal space. According to the 2021 State of the Nation Report issued

by the Economic and Social Council of Jordan, borrowing to cover current

expenditures is one shortcoming of Jordan's fiscal policy, as such loans rarely

go towards capital projects that add value to the productivity of the national

economy, an article run by Amman Net stated.

اضافة اعلان

However, when foreign financing is directed towards productive projects, where does that money come from, and what

projects does it support?

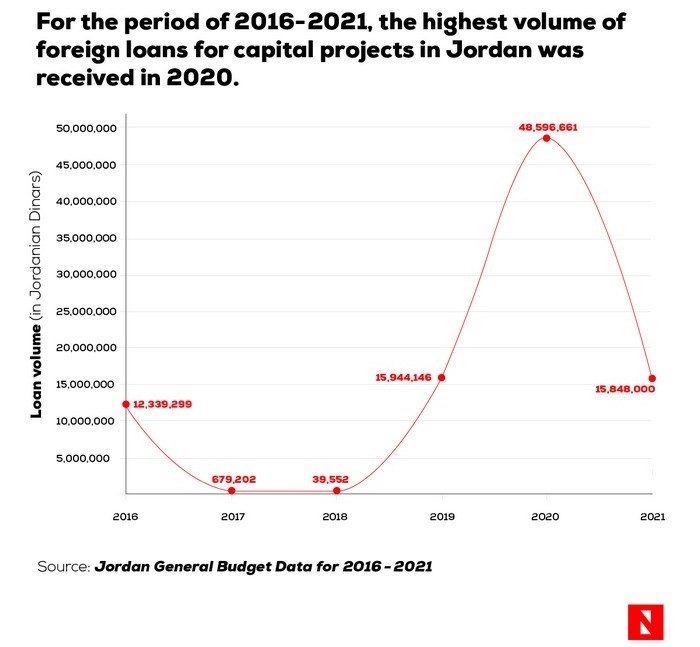

An analysis of general

budget data for the period 2016-2021 reveals significant year-to-year

differences in the volume of foreign loans financing capital projects, with

varying spending priorities.

The highest value of foreign loans financing capital projects was recorded in 2020, when Jordan’s government received approximately JD48.6 million, mainly… designated for completing the Desert Highway rehabilitation project.

According to the

budget data, the highest value of foreign loans financing capital projects was

recorded in 2020, when Jordan’s government received approximately JD48.6

million, mainly provided by the

Saudi Fund for Development (SFD) and designated

for completing the Desert Highway rehabilitation project. In 2018, on the other

hand, foreign loans received for capital projects totaled less than JD40,000.

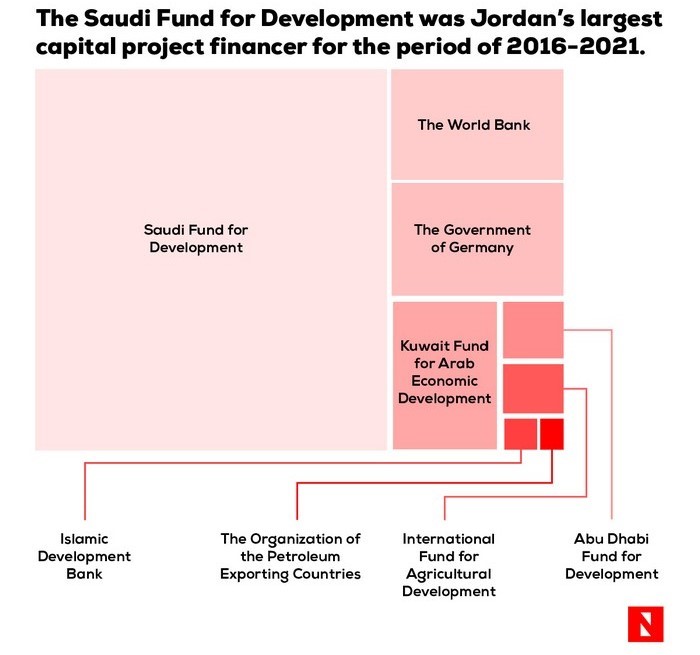

Prominent lending

bodiesFor the six-year

period of 2016-2021, the SFD topped the list of loan providers financing

capital projects in Jordan, supplying the Kingdom with JD67.3 million, or 72

percent of total loans received during that period. The entirety of the SFD

financing went towards the Desert Highway rehabilitation project.

The Saudi fund’s loan

covered about 50 percent of the total cost of the project, while the rest was

financed from Jordan’s Treasury.

Overall, the rate of

contribution of foreign loans to the total financing for Jordan’s major

projects ranges between 67 and 100 percent, with the exception of only the

Desert Highway rehabilitation project (50 percent) and a project to establish

25

schools in 2017.

On Jordan’s roster of

capital project financers, the World Bank came in second for the six-year

period, contributing about JD9.3 million directed mainly towards a project titled

“Education Reform for Knowledge Economy”, which aims to support the Kingdom to

transform the education system at the early childhood, basic, and secondary

levels to instill graduates with the skills needed for the knowledge economy,

according to the World Bank.

For the year 2021, the

Kuwait Fund for Arab Economic Development was the most prominent capital

project financer in the Kingdom, providing loans worth JD7.5 million.

Roads, schools, and

hospitalsOn a sector level,

where does the funding go? As previously mentioned, infrastructure and public

works (such as roads and highways) are one major recipient of capital project

loans in the Kingdom.

Education is another

obvious choice for development projects worldwide, and Jordan is no exception. During

the six-year period from 2016-2021, the education sector received its highest

share of foreign loans for capital projects in 2016, with foreign contributions

to sector development declining between 2017 and 2020.

The health sector also

received significant external funding in 2016 as the Kingdom established the

new

Zarqa Government Hospital and expanded Al-Bashir hospital in Amman. After

that, health projects were absent from the list of capital projects financed by

external loans until the end of 2020, according to data from the general

budget.

Treasury bonds: an

alternative source of funding?Raad Al-Tal, an

economic expert, expressed the opinion that Jordan suffers from mismanagement

of foreign grants, aid, and loans. For example, he explained, the total volume

of grants and loans for the period from 2009-2019 reached JD26 billion,

however, the impact of this significant quantity of funding “was not directly

felt”, whether in the Kingdom’s infrastructure or its health and education

sectors.

The expert also noted

that the administration of grants, aid, and loans is subject to external constraints,

as lenders may determine the field of spending in a way that is inconsistent

with local priorities.

According to a report

issued by the

Jordanian Strategy Forum in 2017, economists consider that the

dependence of the Jordanian government on foreign aid, soft loans, and internal

and external borrowing to finance the country’s deficit and fund capital

projects highlights the need to find alternative sources of financing.

The total volume of grants and loans for the period from 2009–2019 reached JD26 billion, however, the impact of this significant quantity of funding “was not directly felt”.

Experts from the forum

noted that it is “surprising” that bonds issued by the central government and

governmental agencies are not traded in the secondary market.

Tal explained that treasury

bonds represent a type of government debt instrument that the government can

benefit from in operational spending by paying salaries or capital spending, which includes productive projects.

Offering these bonds

for trade in the secondary market can increase their demand, which is then reflected

in the government's ability to finance capital projects, he said. “The broader

the options and the more varied the borrowing mechanisms, the greater the

ability to collect amounts at lower, more competitive interest rates,” the expert

said.

Conversely, the

absence of a sound policy for issuing these bonds increases the government's

dependence on foreign loans, he said.

This article was

produced with support from “100 Watts” for investigative journalism in Jordan,

a joint project by Arab Reporters for Investigative Journalism and the Embassy

of the Kingdom of the Netherlands to Jordan.

Read more Business

Jordan News