In the aftermath of the Arab Spring, Jordan was hit by a double whammy of spiraling unemployment rates and a deceleration in economic growth. Making matters worse, the country was further hamstrung by protracted border shutdowns with Iraq and Syria and financial, livelihood, and social predicaments brought about by poor economic stewardship.

And with the COVID-19 pandemic leaving a trail of economic destruction, the Kingdom had to bounce back with vigor. It needed a new vision to rekindle its economic might and propel it toward a prosperous decade ahead.

Jordan’s financial makeover mission pivots on a bevy of sectors, spanning industry, tourism, and education, complemented by many legislative revamps and numerous strategic infrastructure projects that will be realized through a public-private partnership.

Here is what you need to know about Jordan’s new economic vision, from its divergence from previous blueprints, roadblocks hindering its progress, and the standout investment projects it entails.

Why an economic blueprint?

Jordan is grappling with a sharp surge in joblessness, with unemployment rates skyrocketing to 22.9 percent as of year-end 2022. The country is also battling sky-high public debt rates, hovering at around 110 percent of GDP by the close of the same year. The chronic budget shortfall and other structural dissonances in the business environment— such as steep energy costs (both electricity and oil) and ineffective public administration—add to the challenge. In the Global Competitiveness Report 2022 by the International Institute for Management and Development (IMD), Jordan ranked 56th among the 63 countries surveyed.

Jordan’s financial makeover mission pivots on a bevy of sectors, spanning industry, tourism, and education.

In addition, Jordan contends with pressing challenges surrounding the standard of living, with the poverty rate ballooning to over 24 percent in 2022. According to the Department of Statistics data, 51 percent of Jordanians aged 50 or above have diabetes. In comparison, a third of Jordanian children and 43 percent of women aged between 15 and 49 suffer from anemia.

Jordan’s school students lag behind their global counterparts, with their scores in the International Program for Student Assessment (PISA) coming below par. In three subjects (mathematics, science, and reading), the performance of Jordanian students fell short of the global average, earning them low marks on the world stage.

The Human Capital Index Report 2020 paints a similarly bleak picture, revealing that 52 percent of 10-year-olds in Jordan endure “learning poverty.” This implies that more than half of these children struggle to read and grasp a basic text by the end of primary education. This percentage outstrips theregional average for learning poverty (48 percent) and the average for Jordan’s income group (38 percent). Against this backdrop, and in the wake of the COVID-19 pandemic, key players in Jordan came to terms with the pressing need for a comprehensive economic overhaul.

اضافة اعلان

In January 2022, King Abdullah II addressed the matter publicly and called for a national workshop at the Royal Court. The workshop endorsed an economic vision outlining the parameters of reform initiatives across various sectors for the next decade. The Jordanian monarch, in the message, recognized the deceleration of the economic reform process in the Kingdom. The royal statement highlighted that the reform initiatives were impeded by institutional deficiencies, procrastination in executing programs and plans, bureaucratic complexities, aversion to change, propagation of rumors, and absence of rational and objective discourse.

Furthermore, the COVID-19 pandemic has caused substantial economic and social burdens on the nation. The economic vision was approved in June 2022 after a series of workshops at the Royal Court, which brought together more than 500 experts from various business sectors in the Kingdom.

Objectives, pillars, and feasibility

Over the past two decades, Jordan has rolled out approximately 11 extensive economic plans and several other sectoral plans. Despite the endorsement of all these plans, Jordan continues to face numerous economic issues, as previously mentioned. This brings doubts regarding the commitment of consecutive governments toward implementing these plans and their continuity amid the frequent governmental transitions. It can be contended that the recent economic modernization vision is distinct from its precursors for several reasons, the most salient of which are as follows:

The crux of the economic modernization vision is to reel in one million youth into the job market by 2033.

Firstly, it was formulated within the ambit of a comprehensive state modernization endeavor, as it was ratified concurrently with other schemes aimed at modernizing the political, administrative, and judicial systems.

Secondly, this blueprint explicitly acknowledges the ineffectiveness of the previously endorsed plans, attributing it to inadequate implementation and the lack of efficacious institutional performance.

The past blueprints were riddled with pressing predicaments, namely the deluge of Syrian refugees flooding into Jordan due to the Syrian debacle, the surge of Iraqi refugees following the Daesh takeover of Mosul, and the disruption of Egyptian gas supplies to the Kingdom. Furthermore, the fresh vision boasts an unparalleled hands-on approach from the Jordanian monarch and his heir.

Jordan’s economic overhaul dream is fueled by two main objectives: turbo-charging the Kingdom’s economic growth and raising people’s living standards. To achieve these goals, the vision banks on eight drivers: innovation and leadership, investment, future services, cementing Jordan’s position as a top global tourist destination, high-impact industries, eco-friendly resources, quality of life, and environmental sustainability.

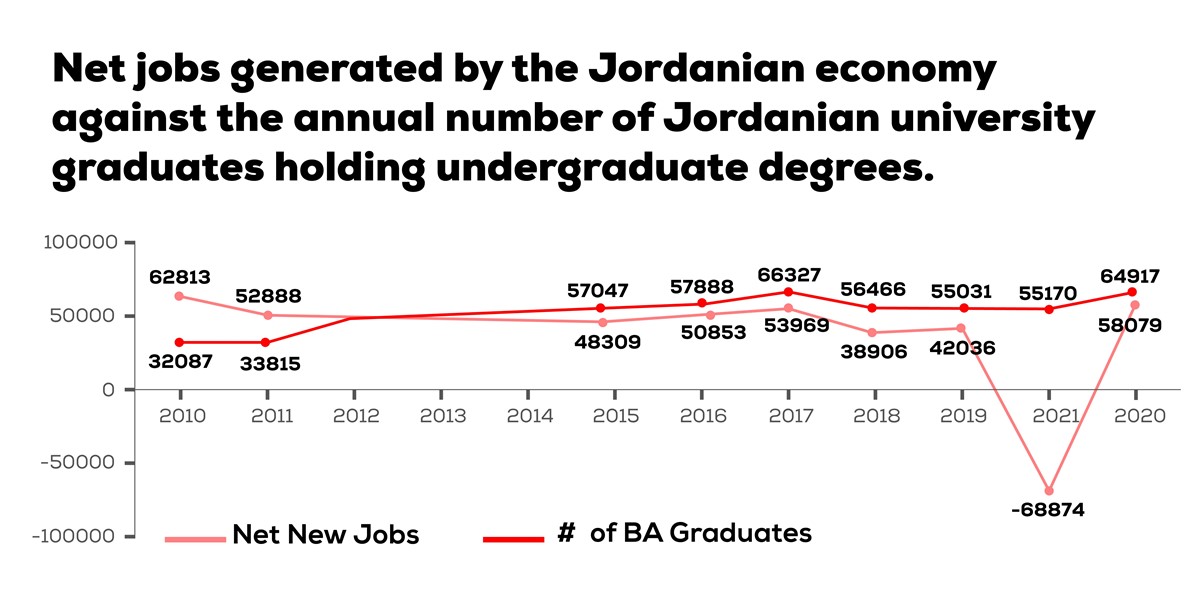

The crux of the economic modernization vision is to reel in one million youth into the job market by 2033, all via three stellar drivers of economic expansion: High-Value Industries, Future Services, and Tourism. The path to realizing this ambitious objective is riddled with numerous obstacles. Carving out a million job openings within a decade implies conjuring up a mind-boggling 100,000 career prospects annually, which is more than twice the current crop of employment opportunities.

Over the 2010–2021 period, the Jordanian economy only yielded a measly 40,000 job vacancies on average, which falls way short of meeting the needs of fresh graduates from Jordanian universities with undergraduate degrees. This figure becomes even more minusculewhen we factor in the influx of job-seekers from vocational education, those without educational qualifications, or those possessing higher academic degrees than a bachelor’s.

Realizing this aim hinges on a duo of crucial requisites: Firstly, attaining the requisite growth rates in various sectors is essential to spawning the desired number of career prospects. Secondly, a holistic overhaul of the education system is imperative, which imbues job seekers with the necessary competencies and capabilities to excel in these sectors.

Education reform takes center stage in this vision, with significant emphasis on revamping the primary, tertiary, and vocational education systems through a comprehensive reform package. The proposed reforms include integrating Fourth Industrial Revolution skills into Jordan’s education system.

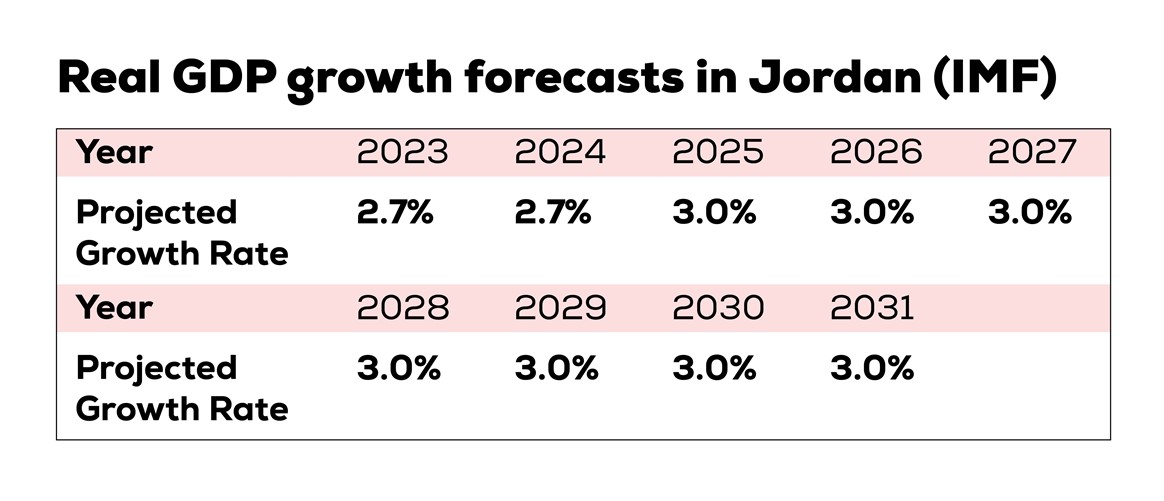

This vision’s growth rates are nothing short of audacious and will require unwavering dedication to bring to fruition. The ultimate objective is to realize an average real GDP growth rate of 5.6 percent from 2023 to 2033, which is leagues ahead of the underwhelming growth projections from the International Monetary Fund (IMF) for Jordan during the same time frame, as outlined in Table 3.

Given the IMF’s pessimistic outlook on Jordan’s economic growth, sluggish global economic expansion, and skyrocketing inflation, it seems unlikely that Jordan would be able to hit the targeted growth rates. The IMF’s projection of a meager 2.9 percent global economic growth rate in 2023 and a slightly improved 3.1 percent in 2024 could further dampen the prospects of Jordanian exports, casting a shadow over the country’s economic aspirations.

If Jordan wants to realize its growth aspirations outlined in its vision, it needs to prioritize crucial reforms to reinvigorate the business landscape. Key among these reforms is the pressing need to make headway in e-government initiatives, given that Jordan has only managed to clinch the 100th position out of 193 countries in the United Nations’ 2022 e-government index. As per the executive program in the vision, Jordan must also streamline and accelerate the regulatory framework governing investors, paving the way for greater ease of business in the country.

While similar initiatives are in place, the executive program remains broad in scope, with many of the proposed measures merely serving as pointers toward developing sector-specific plans and strategies. As a result, there is a dearth of concrete, quantifiable actions geared toward addressing the practical challenges of the business landscape. Hence, attaining the vision’s goals hinges on a robust monitoring and follow-up mechanism to ensure the effective implementation of the proposed measures, thereby averting a repeat of Jordan’s present economic predicament.

At a sectoral level, the high-value industries driver that centers on pharmaceuticals, food, and chemicals presents a fertile ground for fueling economic growth. Nevertheless, the executive program for this sphere appears to be mired in vagaries, which could impede Jordan’s progress in these industries. To succeed in high-value sectors, the government must clarify the roadmap for reforms, particularly concerning energy prices, and capitalize on fresh export prospects in untapped global markets.

The reform matrix is relatively well-defined regarding the driver of future service that relies on communication, information technology, and creative industries. The Jordanian government is outlining measures to bolster the e-commerce space, promoting trailblazing leadership, and steering the shift toward 5G communication services. However, the education issue poses a significant hurdle at the tertiary and K-12 levels, given that human capital forms the crux of this sector.

The “Destination Jordan” driver that heavily hinges on the tourism industry holds significant potential. However, the government’s program appears to place a disproportionate emphasis on tourism promotion alone. To realize this sector’s full potential, greater attention must be devoted to improving tourism transportation and augmenting the capacity to accommodate tourists at popular sites.

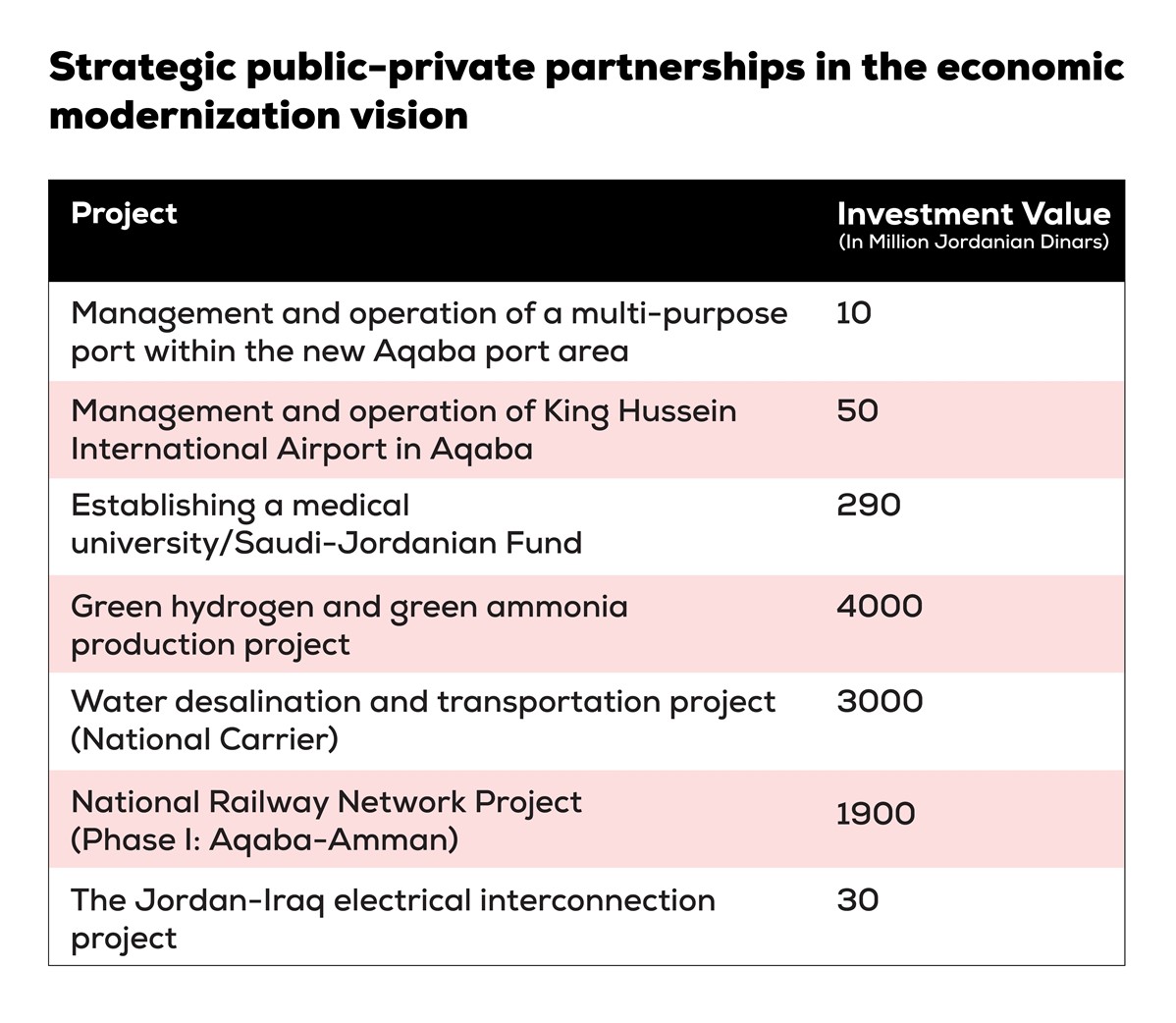

Regarding the government’s program for transitioning to sustainable energy, the executive plan emphasizes natural gas, and the production of green hydrogen and ammonia, with scant attention paid to the solar and wind energy domains. Furthermore, the vision puts forth a series of strategic ventures jointly executed by the public and private sectors, which are elaborated upon in the subsequent section.

Investment opportunities and financing sources

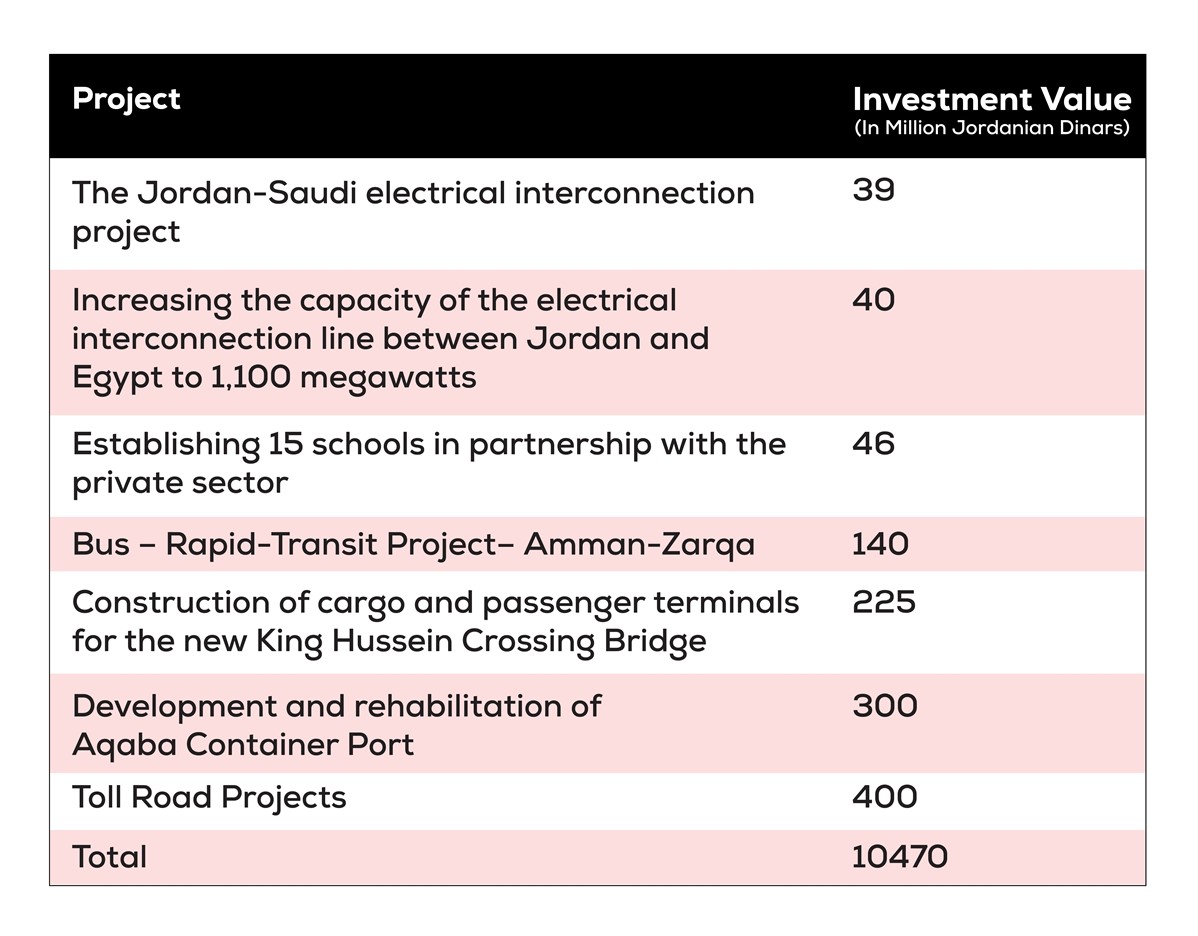

Beyond the ambit of the reform matrix, the economic modernization vision’s executive program alludes to a cohort of pivotal, large-scale initiatives that will be executed in collaboration between the public and private sectors. Collectively, these projects are valued at around JD10.5 billion, translating to approximately $14.8 billion. This encompasses a range of undertakings spanning infrastructure, energy, and education.

And these aforementioned projects rank among the foremost initiatives that will fortify Jordan’s energy security, curtail energy expenses, and bolster the quality of public education and transportation systems. These projects’ specifics and economic viability are yet to be disclosed, contingent on the government’s capacity to lure investors.

Concerning the ventures stemming from the eight growth catalysts delineated in the vision, the mining sphere holds utmost significance, primarily regarding the products emanating from potash and phosphates, such as fertilizers, linked mineral and chemical commodities, pesticides, and carboxylic acid derivatives, among others. Similarly, the pharmaceutical realm emerges as one of the most propitious sectors in Jordan, poised to hit approximately $2.4 billion by 2033, as per the tenets of the economic modernization vision.

If Jordan wants to realize its growth aspirations outlined in its vision, it needs to prioritize crucial reforms to reinvigorate the business landscape.

The communication and information technology domain, alongside business services, engineering, and creative industries, represent the most pivotal sectors with potential investment yields and nominal overheads. These industries hinge primarily on human capital, with the economic modernization vision predicting Jordan’s exports of communication and information technology services to soar to around $6.3 billion by 2033.

Jordan aims to upgrade its logistical transportation and warehousing infrastructure, which could bolster its standing as a hub for regional integration, facilitating the linkage between the Arabian Gulf and the Mediterranean Sea.

Unwavering dedicationJordan’s economic modernization vision for 2023–2033 is ambitious. However, attaining this lofty aspiration hinges entirely on the Jordanian government’s unwavering dedication to enforcing the reforms outlined in its executive program, with a particular emphasis on the legislative realm.

The decision-makers in Jordan, led by the King and Crown Prince, have evinced their resolute intent to execute the vision meticulously and monitor its progress ardently. The vision’s hallmark is its emphasis on several promising sectors, including business services, communication, information technology, pharmaceuticals, and mining. These are already thriving domains that Jordan can leverage to augment its economy.

Nevertheless, Jordan is beset with several challenges, encompassing the macroeconomic milieu, public debt crisis, and the hurdles attendant to the transformation and modernization of the public sector. Concerning the strategic ventures that the public and private sectors will jointly execute, the efficacy and execution of these projects rest entirely on the Jordanian government’s ability to release feasibility studies about the investment initiatives embedded in the executive program of the vision.

It is anticipated that upon completion, these projects will yield a lucrative investment return, spurred by the sprouting business ecosystem in the region and the allure of other countries that offer profitable returns to investors in the various sectors the vision seeks to invigorate.

This article was previously published on the Emirates Policy Center.

Read more Opinion and Analysis

Jordan News